| |

| |

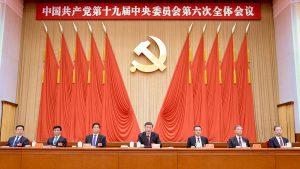

Hello Navneet, With the year coming to a close, we would like to remind you of the upcoming changes to tax exemptions on benefits-in-kind for foreign employees in China starting January 1, 2022. This policy change will have a major impact on the net take-home pay for certain expats. In addition, the tax calculation method for annual one-time bonuses will also change for some taxpayers. If you have any question regarding the upcoming changes, please contact our experts. Year end is also a perfect time to plan for China annual compliance work. See our latest China Briefing magazine, Annual Audit and Compliance: Get Ready for 2022, join our upcoming audit webinar on November 25, or our Ready for 2022: Health Checks for a Compliant, Risk Controlled, and Efficient Business webinar on November 30 to get started. China's much anticipated 'Sixth Plenum' just concluded with the passing of a "historical resolution". We provide insight into what happened and why it matters to give you an understanding of this significant development. In addition, we have selected three sample projects from our M&A matchmaking portal asiamerger™, featured by our experts. You can also list a sell-side project or search buy-side projects for your M&A needs. Lastly, if you are planning to relocate your manufacturing operations to a new market, do read our two new case studies below. Here, our Business Intelligence team explains the importance of a cross country competitiveness benchmarking to make an optimal relocation decision. If you need any support, please do not hesitate to contact us. | | | |

| | SPECIAL SPOTLIGHT: TAXPEDIA | | | |

| China Annual Bonus: Prepare for 2022 Income Tax Policy Change | The preferential income tax treatment for the annual one-time bonus for some tax residents in China will end on January 1, 2022, as the tax policy transition period comes to an end. Other changes include ending the individual income tax exemption for some fringe benefits for expatriates. Employers and employees should be clear about the coming changes and make adequate preparation to reduce extra tax burden. | | READ MORE | |  | Tax Implications for Chinese Permanent Residence ID Card Holders | Many foreigners have concerns over getting a Chinese Permanent Residence (PR) ID Card as they are not sure whether this will impact their tax residency status in China, or whether they will be liable to pay tax on worldwide income in the country. We discuss the tax residency status of foreigners with a Chinese Permanent Residence ID Card and their tax liability on worldwide income in the country. | | READ MORE | | | |

| |

| The Sixth Plenum: What is it and What Has Been Decided? | Nearly 350 members and alternate members of the CCP Central Committee have gathered in Beijing since November 8 to review the Resolution on Major Achievements and Historical Experience of the CPC's 100 Years of Endeavors, which has been touted as being of "historical significance" and is only the third such resolution since the CCP's foundation 100 years ago. | | READ MORE | |  | Beijing's Services Sector Opens More Areas to Foreign Investment | China's capital received the green light from the State Council to further open parts of the Beijing service sector to foreign investment. The affected industries include areas that were previously off-limits, such as education, telecommunications, construction, performing arts, and more. We discuss what impact this could have on foreign investors. | | READ MORE | | | |

| |

| |

China's FY2021 Annual Audit: What's New and How to Prepare? Webinar | Thursday, November 25, 2021 | 4:00 PM China / 3:00 PM Vietnam / 9:00 AM CET As the year comes to an end, companies and their finance teams will be busy closing their accounts and preparing for their annual audit. For small and medium size companies (SMEs) with limited manpower, this will be an especially busy time of the year. Join us as Audit Manager, Jess Feng, introduces the general auditing process and what you need to do to prepare for your upcoming financial audit. | | | |

| |

Ready for 2022: Health Checks for a Compliant, Risk-Controlled, and Efficient Business Due to unforeseen circumstances this webinar will be postponed to Tuesday, Nov 30, 2021. Webinar | Tuesday, November 30, 2021 | 5:00 PM China / 4:00 PM Vietnam / 10:00 AM CET A common method to assess the "health" of a business is to perform the audits and checks required by PRC law, however, additional "health checks" can be used to further protect your business. These internal or external "health checks" can help firms identify and prevent possible non-compliant operations and risks. In this webinar, Viktor Rojkov, International Business Advisory Senior Associate, will discuss the current business environment in China in terms of compliance and risks, and highlight common situations in which companies should perform a "health check." | | | |

Viktor Rojkov Senior Associate, International Business Advisory China | | | |

Tax Incentives in China: How Businesses Can Successfully Utilize Them? Webinar | Thursday, December 2, 2021 | 4:00 PM China / 3:00 PM Vietnam / 9:00 AM CET Tax incentives in China are a common method of encouraging investment in particular industries or regions and are often offered through Corporate Income Taxes (CIT). Certain industries and cities may have a lower CIT and give business a preferential CIT rate. Tax incentives that nurture and encourage post-COVID economic growth are a key pillar for Chinese economic and employment recovery. Hannah Feng, Partner at Dezan Shira & Associates, will discuss the current tax incentive policies and local implementations with a focus on the high-tech industry and specific regions in China such as the Greater Bay Area (GBA), Hainan Free Trade Port (FTP), and certain areas in Beijing. | | | |

| |

Managing Non-Trade Intercompany Transactions with Your Chinese Affiliates Webinar | Wednesday, December 15, 2021 | 4:00 PM China / 3:00 PM Vietnam / 9:00 AM CET In this webinar, Riccardo Benussi, Head of European Business Development, Shirley Chu, manager from our transfer pricing team, and Ann Sun, manager from our corporate accounting team will discuss the difficulties faced by multinational companies in terms of non-trade cross-border intercompany transactions and how they could be affected by China's transfer pricing policy, along with the tax implications and payment procedure of some common forms of such transactions. Cindy Yin, operation manager of BNI China will join us as a special guest to share her experience in cross-border royalty payments and service charges. | | | |

| Ann Sun Assistant Manager, Corporate Accounting Services China | | | |

| |

Annual Audit in China With the scope and penalties of China's social credit system being further clarified in 2021, legal and regulatory compliance has become more important than ever. More attention should be given to the annual compliance procedures as mandated by various governmental departments. In this issue of China Briefing magazine, we walk foreign businesses through the annual audit and compliance process from start to finish. | | READ MORE | | | |

| | CASE STUDIES - FOCUS ON BUSIENSS INTELLIGENCE | | | |

| |

| |

| |

| |

| | CONNECT WITH US ON WECHAT | | | |

Never miss an update. Scan the QR code to follow our official WeChat account to discover the latest China Briefing articles, upcoming events, webinar recordings, company news and more. | | | |

| |

| |

| |

| | READ OUR PUBLICATIONS FROM ACROSS ASIA | | | |

| |

| |

| | © 1992-2021 Dezan Shira & Associates All Rights Reserved. | | | |